McCulloch v. Maryland

The McCulloch Bank’s Good Ol’ Fashioned Rip-Roarin’ Stunt Show

When you were a child, didn’t you always dream of being a bank teller? How about working at one of the most famous banks in Supreme Court history? Well, put on your green visor and get behind the bars of your teller’s station. The year is 1818 and Mr. James McCulloch just hired you to work at the Maryland branch of the Bank of the United States. Stay alert, because while you’re totaling your drawer at the end of the day, a Constitutional Moment might occur. When Maryland state officials appear and place a tax on your bank-notes, hold onto your green visor and watch McCulloch’s Good Ol’ Fashioned Rip-Roarin’ Stunt Show! Federal bank officials and state tax collectors will jump and roll through pratfalls and over pitfalls, fly out bank windows, fall down stairs and ride on the craziest run away wagon train ride in Constitutionland.

It’s a fun filled stunt show like no other….you can BANK on it!!!!

What is Necessary and Proper?

Article I, Section 8 of the United States Constitution reads: "The Congress shall have Power ... To make all Laws which shall be necessary and proper for carrying into Execution the foregoing Powers, and all other Powers vested by this Constitution in the Government of the United States, or in any Department or Officer thereof." Want to learn more about it? Absolutely! But, frankly, I've got a family and a job so, this is still under construction.

McCulloch v. Maryland In Depth

Citation

17 U.S. 316 (1816)

Facts

In 1816, the U.S. Congress enacted a law incorporating the Second Bank of the United States. A branch of the bank was opened in Baltimore in 1817. Within one year, the General Assembly of Maryland passed “an act impos[ing] a tax on all banks, or branches, thereof in the State of Maryland, not chartered by the legislature.” James McCulloch, cashier of the Baltimore Branch, refused to pay the tax. A Maryland trial court upheld the state’s right to lay and collect the tax on the Bank of the U.S. The state Court of Appeals affirmed. The case was appealed to the U.S. Supreme Court.

What is the Nature of a Constitution?

At the outset of his unanimous decision, Chief Justice John Marshall addresses the argument posed by the attorneys for the state of Maryland that the Constitution was “the act of sovereign and independent states.” The issue is whether the Constitution emanates from the people or the states? Simply stated, was the Constitution created by act of the people or as an agreement among the states? In response, Marshall examined the drafting of the Constitution and ratification process. Although the members of the Constitutional Convention were “elected by the state legislatures” the completed document was “submitted to a convention of delegates chosen in each state by the people thereof.” Thus, Marshall concluded the United States government “is emphatically and truly a government of the people” and not a contractual agreement among the several state governments. Since the power of the federal government emanates from the people, it cannot be overruled by the states. Thus, when state and federal law conflicts, the latter, as the product of the people, wins; “the government of the Union, though limited in its power is supreme within its scope of action.”

“Has Congress the Power to Incorporate a Bank”

Early on, Chief Justice John Marshal poses this question as the primary issue in the case. After all, the federal government may trump the state governments, but if the federal government is not constitutionally empowered to create the bank, the case would be decided in Maryland’s favor. That is to say, the federal government is supreme but only “within its scope of action.” Further, the powers of the federal government are limited. Article I Section 8 of the U.S. Constitution lists the enumerated powers of the federal government; the states remain in control of all matters outside said enumerated powers. Turning to the matter of establishing a federal bank, Marshall began “[a]mong the [federal government’s] enumerated powers, we do not find that of establishing a bank.” However, a constitution by its nature is a mere outline of the powers of the federal government. To itemize every power would be the equivalent of creating a “legal code.” Marshall summarized this concept in the most famous sentence ever written in the history of the U.S. Supreme Court: “In considering this question, then, we must never forget that it is a constitution we are expounding.”

Although the power to create a bank is not among the enumerated powers, other powers, such as the power “to lay and collect taxes; to borrow money; to regulate commerce; to declare and conduct a war; and to raise and support armies and navies” are listed. From these powers, Marshal concludes the government “must also be entrusted with ample means for their execution.” In fact, at the end of Article I, Section 8, the Constitution explicitly gives Congress the power “To make all Laws which shall be necessary and proper for carrying into Execution the foregoing powers.” This is called the necessary and proper clause. By way of example, Marshall cites the power “to establish post-offices” necessarily includes “the power and duty of carrying the mail…[and]…the right to punish those who steal letters.” Based on the necessary and proper clause, these ancillary powers stem from the enumerated power. He concludes:

“Let the end be legitimate, let it be within the scope of the constitution, and all means which are appropriate, which are plainly adapted to that end, which are not prohibited, but consist with the letter and spirit of the constitution are constitutional.”

Thus, Marshall holds the law creating the Bank of the United States constitutional.

Can Maryland Tax the Bank of the United States?

Once Marshall establishes that “the American people have declared their constitution…to be supreme,” the Chief Justice concludes “supremacy” means “to remove all obstacles” to the “actions” of the federal government. Since “the power to tax involves the power to destroy” the Supreme Court held the Maryland tax on the Bank of the U.S. “unconstitutional and void.” In sum, “the states have no power, by taxation or otherwise, to retard, impede, burden or in any manner control, the operations of the constitutional laws enacted by congress.”

McCulloch in Ten Easy Steps

1. U.S. Congress creates the Bank of the United States

2. Maryland taxes the notes of the Bank of the United States.

3. The Bank of the U.S. (through McCullough of the Maryland Branch) refuses to pay the tax.

4. Marshall says the federal government, created by the people, is supreme to the state governments. (In “rock, paper, scissors” terms, the federal government is “paper” and the state government is “rock.” Hmmm….maybe the people are “scissors” except the state can’t smash the people. So, forget it.)

5. The federal government is given a list of things in the constitution that it can do.

6. The federal government is only supreme if it is doing something it is allowed to do as listed in the constitution.

7. The list of things it can do does not include creating a bank but it does include collecting taxes, borrowing money, regulating trade between the states, paying for an army.

8. The constitution says the federal government can also do other types of things (“necessary and proper”) in order to help do the things the constitution actually says it can do.

9. Creating a bank is one of those other types of necessary and proper things.

10. And, since a tax is a burden, the state cannot burden the federal government in doing things it is allowed to do, such as creating and running a bank.

It’s the oldest story in the world…Congress creates a bank, a state taxes the bank, the Supreme Court says Congress can create a bank and the state can’t tax it…and, Marshall declares the federal government supreme, and the Bank of the United States lives happily ever after, for like 13 years and then Andrew Jackson, being the big jerk that he is, kills it because he doesn’t like it.

McCulloch Fun Facts

1. Who was James McCulloch?

James William McCulloch was the cashier of the Baltimore Branch of the Bank of the United States. His Constitutional fame stems from his issuance of “respective bank-notes therein described, from the said branch or office, to a certain George Williams, in the city of Baltimore, in part payment of a promissory note of the said Williams, discounted by the said branch or office, which said respective bank-notes were not, nor was either of them, so issued, on stamped paper, in the manner prescribed by the act of assembly.”

In 1821, James McCulloch, along with bank president James Buchanan and the same George Williams who received the promissory notes in McCulloch v. Maryland, were indicted for conspiracy to defraud the bank. The three men were accused of taking interest free loans of bank notes without paying interest. The case was originally dismissed for failure to charge a crime and because the state had no jurisdiction. Since the Bank of the United States was a federal agency as opposed to an agency of the state of Maryland, the court concluded the case did not belong in state court. On appeal, the dismissal was reversed and the men stood trial. Eventually, they were acquitted.

From McCulloch v. Maryland 17 U.S. 316, 318-319 (1819) and from A Court of Appeals of Maryland Time Capsule: Six Historic Arguments in the Nation’s Oldest Appellate Court, 30 University of Baltimore Law Forum, 13 (Summer/Fall 1999)

2. The First Bank of the United States: Jefferson vs. Hamilton

The First Bank of the United States was chartered by Congress for 20 years on February 25, 1791. The concept of the bank was the brainchild of Alexander Hamilton, the first Secretary of the Treasury and a visionary for the great future of America. Early in his tenure at Treasury, Hamilton was asked by Congress to submit an economic plan for the young nation. A central ingredient in that plan was the establishment of a national bank. Patterned after the Bank of England, Hamilton’s Report on the Bank laid out its details. A 20 year charter would be given by Congress to only one National Bank with initial capital of $10 million ($2 million from the government and $8 million from private investors). The Bank could issue notes which would be accepted by the government for payment of taxes. According to author David Cowen, this last feature “would provide the Bank with a strong advantage over its competitors.” The benefits of the Bank, per David Cowen, included providing the fledgling nation with “a ready source of loans, a principal depository for federal monies…and a clearing agent for payments on the national debt.” The government would share in the profits “as the largest stockholder.”

The Bank bill passed the House on December 13, 1790, and the Senate on January 20, 1791. It sat on President George Washington’s desk awaiting his signature. Washington asked the advice of his most trusted lieutenants on the merit of the Bank Bill. Both his Secretary of States, Thomas Jefferson, and in response to Mr. Jefferson, Alexander Hamilton responded in now famous pieces which embodied their philosophies on the future of the American economy.

Jefferson’s Response

Jefferson responded to Washington in no uncertain terms: “The incorporation of a bank, and the powers assumed by this bill, have not, in my opinion, been delegated to the United States, by the Constitution.” In a point by point analysis, Jefferson began with the text of the Constitution arguing the power to incorporate a bank is “not among the powers specifically enumerated.” Turning to the Necessary and Proper clause, Jefferson argued the existence of a national bank is not “necessary” for governing and therefore, not constitutionally authorized: “the Constitution allows only the means which are ‘necessary,’ not those which are merely convenient.” Thus, Jefferson encouraged President Washington to veto the Bank bill:

“The negative of the President is the shield provided by the Constitution to protect against the invasions of the legislature: 1. The right of the Executive. 2. Of the Judiciary. 3. Of the States and State legislatures. The present is the case of a right remaining exclusively with the States, and consequently one of those intended by the Constitution to be placed under its protection.”

Hamilton’s Response

George Washington requested his Secretary of the Treasury to respond to Jefferson’s Opinion. In “Hamilton’s Opinion as to the Constitutionality of the Bank of the United States,” the Secretary addressed the critiques of the bank opponents and advocated for a strong central government. He argued the Constitution granted the federal government with “a right to employ all means requisite and fairly applicable to the attainment of the ends of such power, and which are not precluded by restrictions and exceptions specified in the Constitution.” To Hamilton, the Constitution grants “implied as well as express powers.” Taking issue with Jefferson’s view of the Necessary and Proper Clause, Hamilton argued something is “necessary” when “the interests of the government…require, or will be promoted by, the doing of this or that thing.” As an example, he looked to “the Act concerning lighthouses,” an Act passed by the first federal congress to finance the construction of coastal lighthouses. Clearly, the act was passed under “the powers of regulating trade” but lighthouses were not a “necessity.” To Hamilton, a Constitution “ought to be construed liberally in advancement of the public good.” Hamilton’s summary of his view of interpreting a constitution sounds very similar to the words of John Marshall in McCullough:

It leaves, therefore, a criterion of what is constitutional, and of what is not so. This criterion is the end, to which the measure relates as a mean. If the end be clearly comprehended within any of the specified powers, and if the measure have an obvious relation to that end, and is not forbidden by any particular provision of the Constitution, it may safely be deemed to come within the compass of the national authority. There is also this further criterion, which may materially assist the decision: Does the proposed measure abridge a pre-existing right of any State or of any individual? If it does not, there is a strong presumption in favor of its constitutionality, and slighter relations to any declared object of the Constitution may be permitted to turn the scale.

Ultimately, President Washington agreed with Hamilton’s view of a strong Constitution enhanced by a liberal reading of implied powers. He signed the Bank Bill on February 25, 1791. Thus, the First Bank of the United States was born.

Excerpts are from the following sources:

• Cowen, David. “First Bank of the United States” EH.Net Encyclopedia, edited by Robert Whaples. March 16, 2008. URL http://eh.net/encyclopedia/article/cowen.banking.first_bank.us

• Jefferson’s Opinion on the Constitutionality of a National Bank: 1791, http://avalon.law.yale.edu/18th_century/bank-tj.asp.

• Hamilton’s Opinion as to the Constitutionality of the Bank of the United States: 1791: http://avalon.law.yale.edu/18th_century/bank-ah.asp

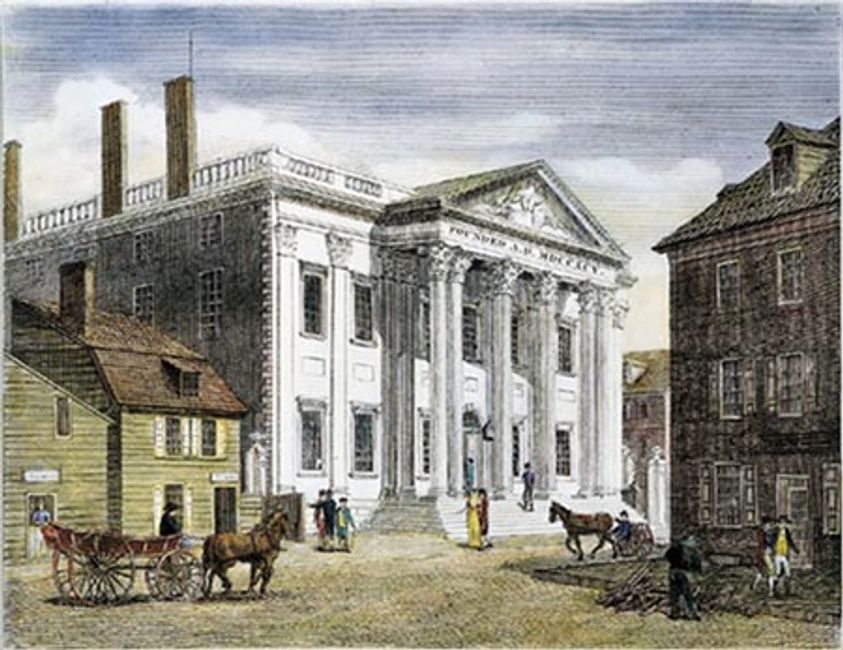

3. The First Bank of the United States: A Brief History

On July 4, 1791, $8 million worth of bank stock was issued to the public and purchased quickly (the biggest stock offering in the U.S. to that date). The headquarters of the bank were located in Philadelphia (opened December 12, 1791), with four branches opening in 1792 (in New York, Baltimore, Boston and Charleston) and an additional four branches opening from 1800 to 1805 (in Norfolk, Washington, Savannah and New Orleans). The Bank served the purpose Hamilton had expected, issuing bank notes which worked as a safe and secure form of paper money. The backing of the federal government helped. The Bank of the United States assisted the federal government in obtaining financing (receiving over $6 million in loans) and helped finance the Louisiana Purchase. As the 20 year lease came to an end, and Congress debated renewal, political forces mobilized and narrowly defeated the bill. The bank closed for business on March 31, 1811. For a more thorough history, see The First Bank of the United States, by David Cowen, http://eh.net/encyclopedia/article/cowen.banking.first_bank.us.

4. The Second Bank of the United States: A Very Brief History

Five years after the First Bank of the United States closed its doors, the Congress voted to charter the Second Bank of the United States for a 20 year term. President James Madison and his Secretary of the Treasury Albert Gallatin, championed reinstituting the bank to help finance the war debt from the War of 1812. Many of the legislators who, for political reasons were against re-chartering the First Bank, supported the Second Bank for pragmatic reasons. The nation’s finances were in better shape during the tenure of the First Bank. Nicholas Biddle, the head of the Second Bank of the US sought another extension, four years before expiration. Although the bank charter was renewed by the Congress, Andrew Jackson vetoed the bill. President Jackson used the bank as a villain in his populist approach of appealing to the common man. The Second Bank was capitalized at $35 million, with 80% of its stock owned by private individuals. The criticism was the bank was a tool for wealthy speculators. However, Andrew Jackson’s personal hatred of big business and the wealthy clearly influenced his decision. Incidentally, we hate Andrew Jackson at Constitutionland. For more on that topic see ANDREW JACKSON IS A BIG CONSTITUTIONAL JERK (link to follow).

From Cowen, David. “First Bank of the United States” EH.Net Encyclopedia, edited by Robert Whaples. March 16, 2008. URL http://eh.net/encyclopedia/article/cowen.banking.first_bank.us

5. How did Maryland tax the bank?

In 1818, the general assembly of the state of Maryland passed “An act to impose a tax on all banks or branches thereof, in the State of Maryland not chartered by the legislature.” Other states passed similar laws, mostly the creation of politicians who remained against the national bank. The law stated if a bank not established/ authorized by Maryland opened a branch in the state, then any notes issued by said bank must be issued on “stamped paper.” For example, “every five dollar note shall be upon a stamp of ten cents…and every thousand dollar note, upon a stamp of twenty dollars; which paper shall be furnished by the Treasurer of the Western Shore, under the direction of the Governor and Council, to be paid for upon delivery.” However, said banks could “relieve itself from the operation of the provisions aforesaid by paying annually, in advance, to the Treasurer of the Western Shore, for the use of State, the sum of $15,000.” The penalty for not complying was a $500.00 fine for each offense, and a $100.00 fine for circulating an unstamped note. The historic decision, McCulloch v. Maryland began when James W. McCulloch, the cashier of the Maryland branch, refused to pay a $100 fine, apparently for circulating bank note without the requisite Maryland stamp.

From McCulloch v. Maryland 17 U.S. 316, 318-319 (1819)

6. What attorneys argued McCulloch v. Maryland?

Daniel Webster, William Wirt (U.S. Attorney General) and William Pinkney argued the case on behalf of McCulloch, and thereby, on behalf of the Second Bank of the United States. Luther Martin argued the case on behalf of Maryland. For more on that topic see THE GREAT ORATORS RIDE (link to follow).

7. Is the Bank of the United States around today? Is a National Bank “Necessary”?

There was never a third or subsequent Bank of the United States after Jackson’s veto of the bill to re-charter the Second Bank of the United States. Some economists argue the American economic roller coaster ride of booms, panics, busts and depressions stemmed from the absence of a bank of the United States. This is a debate for in Economics-Land, but not in Constitutionland. A question that arises in light of the end of the Bank of the U.S. is whether a national bank is, in fact, “necessary?” This brings us back to the Jefferson-Hamilton debate as to the meaning of the word “necessary.” Certainly, Jefferson said, and would argue today the absence of a Bank of the U.S. is further proof it was never necessary. Hamilton would argue the Bank of the U.S. as an aid to the Congress and federal government in enacting other enumerated powers has been replaced today by the Federal reserve system—even a further reach from the original constitution. Somewhere, Hamilton is smiling and Jefferson is crying.